- #Printable budget workbook for free

- #Printable budget workbook how to

- #Printable budget workbook full

20% to savings and debt repayment: This will allow you to either pay down your current debts or bulk up your savings to avoid future debt.This 30% goes to things like travel, memberships, and events. 30% to wants: “Wants” are expenses that are meant for fun and enjoyment.50% to necessities: These are the expenses you cannot avoid such as your mortgage payment, transportation, and food.This budget splits your income across 3 major categories: 50% to necessities, 30% to wants, and 20% to savings and debt repayment. Getting to zero may mean investing money into a retirement account or a “rainy day” fund.Ĥ.) Once your zero based budget is set, you’ll start tracking your expenses throughout the month and document them. This also does not mean you’re spending every dollar in the traditional sense. This will most likely take a few tries and playing around with your flexible expense numbers. I like to make three separate columns of expenses: one for “hard” expenses which include unchanging, mandatory costs such as your mortgage and phone bill, one for “flexible” expenses such as eating out and entertainment, and “irregular” expenses such as quarterly insurance bills.ģ.) Subtract your expenses from your income to equal zero. Dave offers 4 easy steps to starting the zero-based budget:ġ.) First, write down your total income for the month after taxes.Ģ.) Next, list out all of your expenses.

#Printable budget workbook how to

One of Dave Ramsey’s core teachings is how to budget your money each month.ĭave uses the zero-based budget method which I have found to be extremely useful.

#Printable budget workbook for free

This includes my budget! I have made google budget planners for many people in my life, however, I think Hannah from Eat Drink and Save Money does a phenomenal job at explaining exactly how to do it, for free might I add!Ī few years ago I was introduced to Dave Ramsey, a financial advisor known for his debt-reducing and money-saving courses.ĭave Ramsey has written multiple books, has his own show, and hosts a podcast all about how to be financially smart and found.

Blogging, when I am working on my Masters, personal endeavors, etc. I use Google Drive for just about everything. Do you spend a lot of money on eating out and would like to switch to making food at home (Link to future grocery savings post)? Are you trying to save for a Disney vacation or pay off debt? How do you know which budget plan is right for you and your family? I’ve listed a few of the top budget systems to help you get started. You can input more but just your location will give you a high degree of accuracy.Ĭhoosing a budget system is all about where you are in your current financial state and what you value in your day to day life. All you have to do is input your earnings and location. SmartAsset has a paycheck calculator that lets you estimate how much you will make after tax. You should be able to figure out your income from past paychecks or earnings but if you don’t, I have a great tool for you.

#Printable budget workbook full

This includes full time and part time jobs, freelance work, Social Security checks, and any other sources of income.Ĥ.) Revisit and revise your budget as you go So how do you make a budget and which printable budget planner should you choose? No matter what budget system you choose, the steps are fairly consistent for each:ġ.) Figure out your after-tax income per month. You get to choose what speaks to you more. Some of these printable budget planners are thoughtless, you take percentages of what you make to find where they belong, some of them are more complex. No matter who you are, education level, or if you are broke or rich – you can and need to make a budget. Having a plan, and knowing that there is a win somewhere down the road, means you’ll sleep better. How many nights have you tossed and turned because of financial worries? We all have. I really want to be 80% debt free but with my student loans, it’s going to take some serious dedication.

What’s your long term financial goal? Maybe that vacation you’ve always wanted. Which is a sure path to debt, late payments, and a lower credit score.Ī budget keeps your eye on the prize. It will give you a clear path to financial success.Ī budget makes sure you don’t spend money you don’t have.

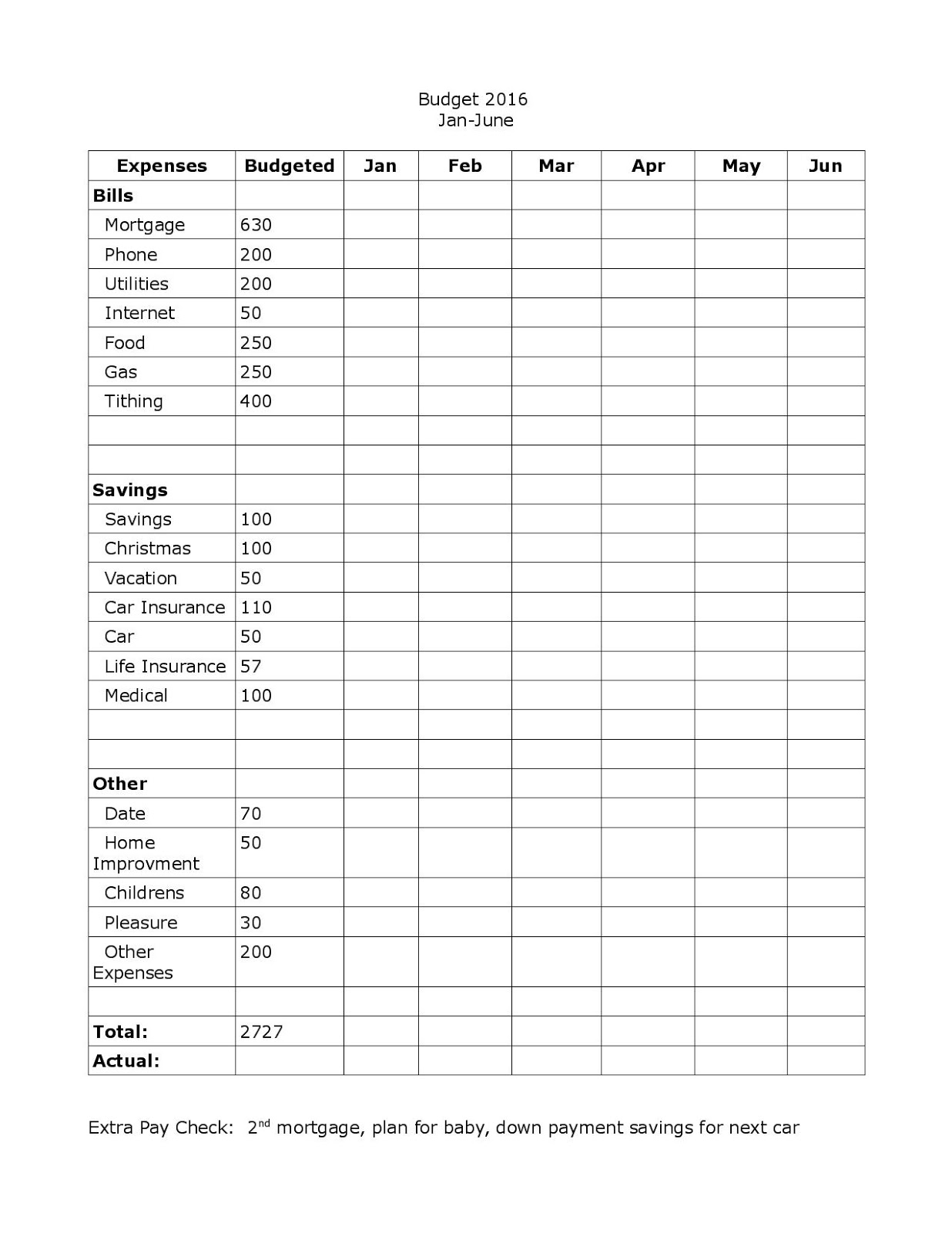

A budget is a plan on how to spend your money, without a plan how can you make sure that you have enough money for the essentials?Ī budget will keep you out of debt or help you get out of debt. Think of it this way, would you go to an unknown country without a plan? I’m guessing you wouldn’t. Making and sticking to a monthly budget is the best way to save and track your money, especially when you’re living a frugal lifestyle. Today we are going to review how to make a budget and I will also provide some awesome printable budget planners for you to use. I can’t emphasize enough how important having a budget is.

0 kommentar(er)

0 kommentar(er)